|

||||

Potash Basics |

Potash is a vital and replenishing agriculture fertilizer used worldwide to grow healthy crops |

Potash is also used to make industrial products and pharmaceuticals |

Canada has the largest and richest potash resources on the globe, and could supply the needs of farmers worldwide for several hundred years |

Canada has approximately half the world’s potash reserves |

|

How it’s Mined & Processed |

|||

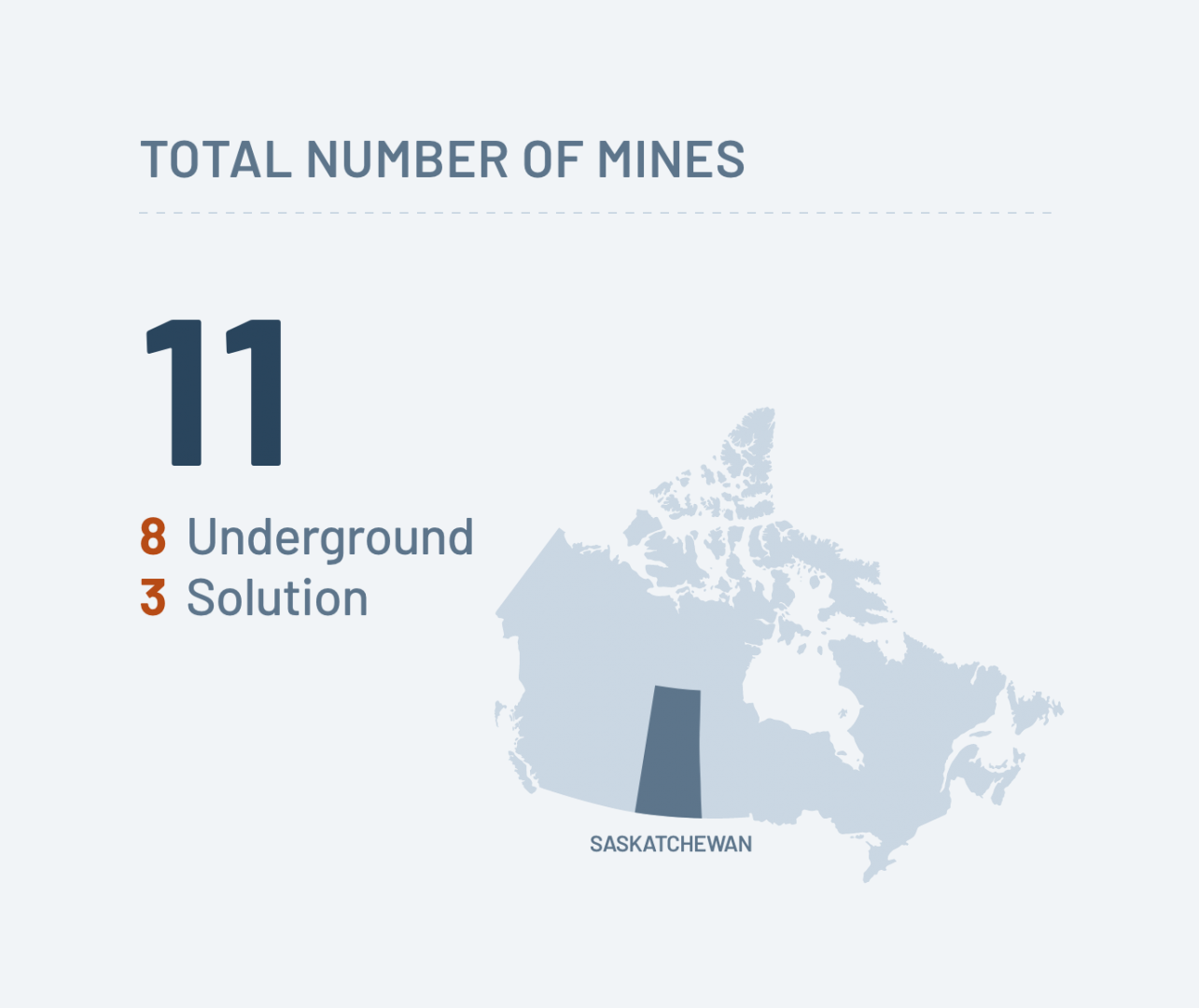

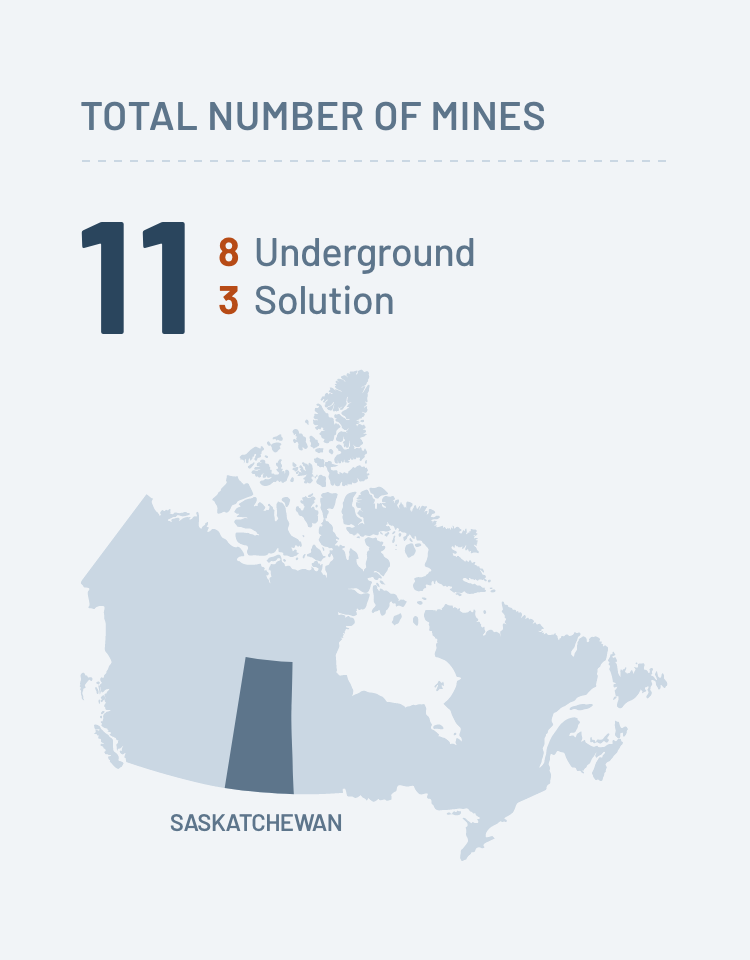

The Canadian Potash IndustryThere are 3 companies producing and selling potash in Canada as well as 2 greenfield projects in various stages in Saskatchewan |

New Potash Projects (as of 2025) CanadaThere are 2 potash projects under development in Canada.  Russia / BelarusThere are 7 projects underway in Russia and Belarus.  LaosThere are 2 projects being developed in Laos. |

|

|

|

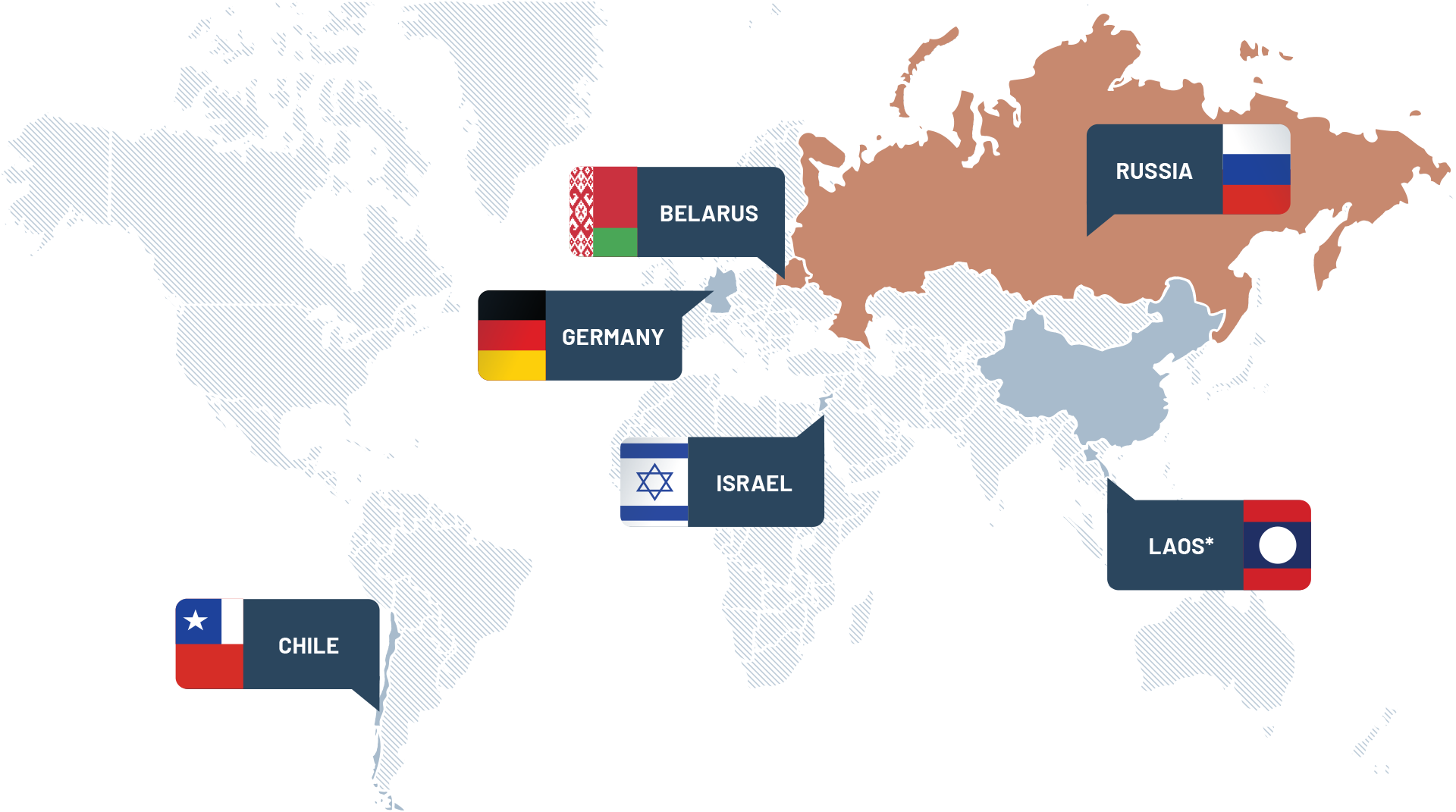

Global Players Outside Canada |

RussiaExporters: Uralkali and Eurochem BelarusExporters: Belaruskali IsraelExporters: ICL ChileExporters: SQM ChinaLaos*Exporters: Lao Kaiyuan and Asia-Potash *Chinese-owned Source: CRU/IFA |

|

||

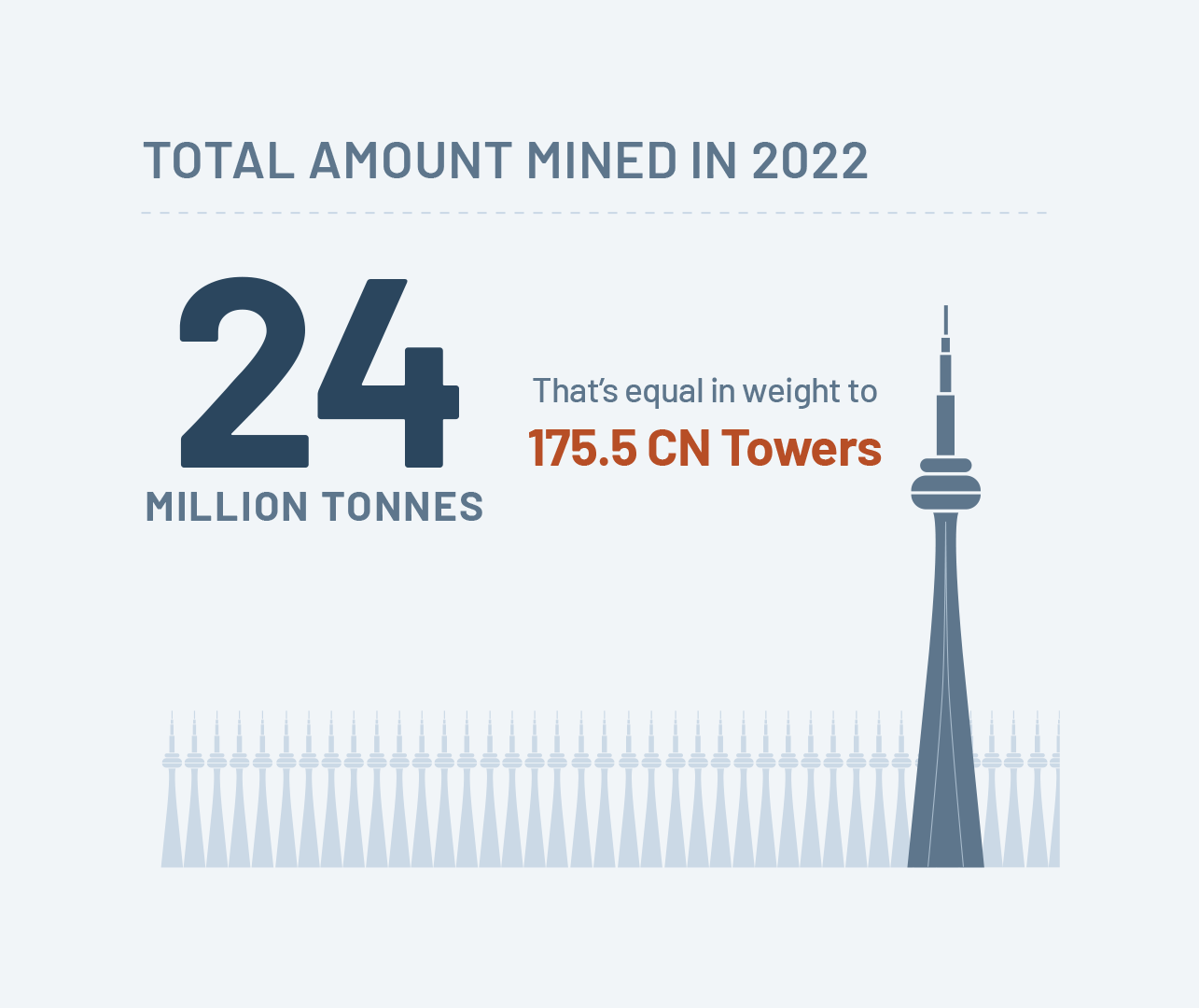

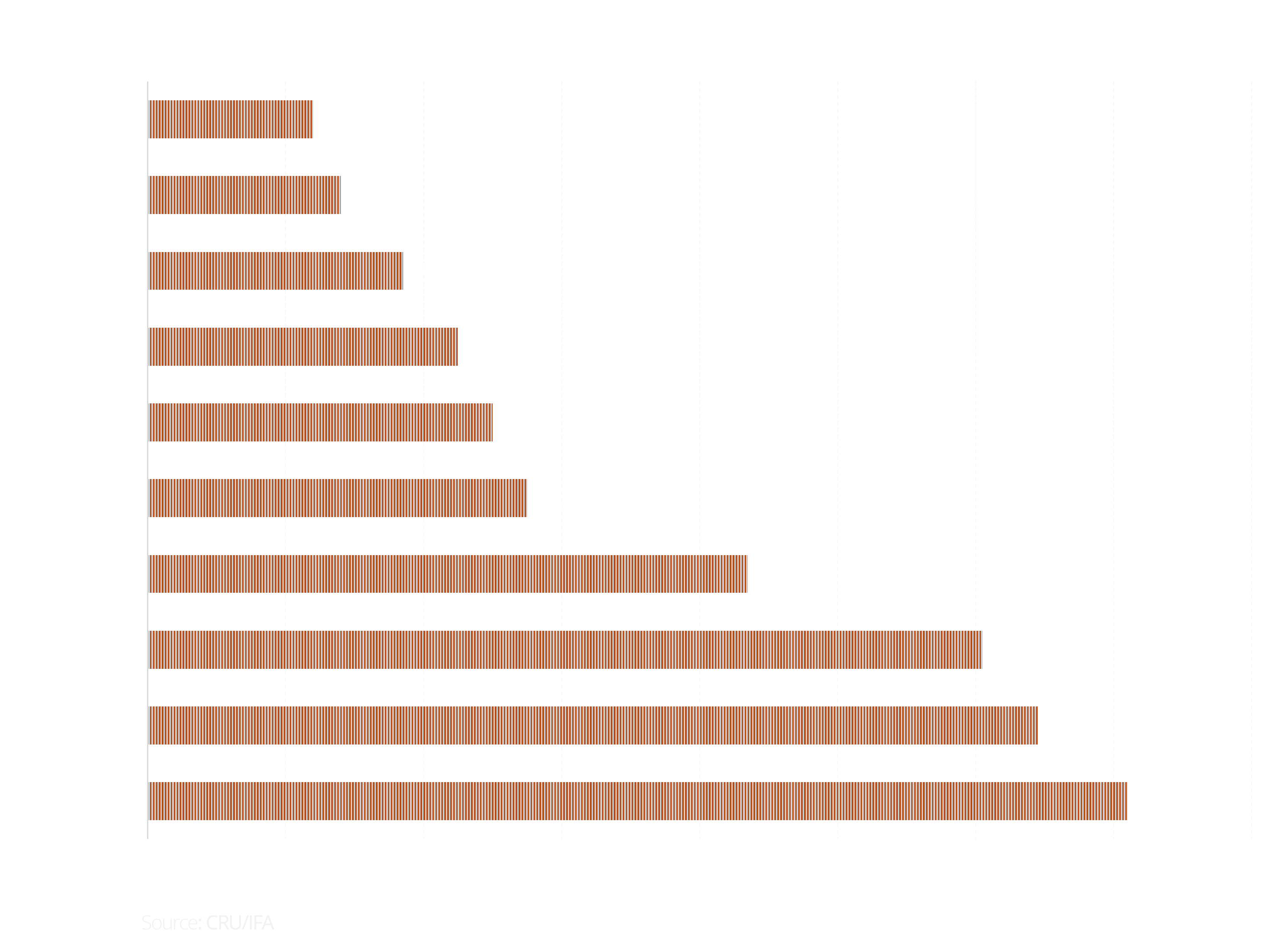

Global Potash Production |

Potash Production by Company Based on 2024 Actuals & Estimates  |

|||

|

Where Canadian Potash Goes |

95% is exported out of Canada Major markets: US, China, Brazil and India; 40 countries world-wide Potash is transported both by the producers themselves and for some, through Canpotex (a joint venture owned by Mosaic and Nutrien) The three main producers own or lease specialized railcars to move product through their own supply chains Potash is moved by train and relies on the services of CN and CP Rail Canpotex markets and delivers Canadian potash through their fleet of 5,000 customized railcars to port terminal facilities in Portland, Oregon, Saint John and Vancouver Rail cars are emptied into large containers and put on ocean-going vessels for global shipments |

||

Journey of a Rail Car of Potash |

||||

The Cost to Produce PotashCompanies producing potash in Canada have the highest business costs in the world New, unexpected costs can’t be passed along to the end user Like any business or industry, companies selling Canadian potash are trying to lower costs to stay competitive |

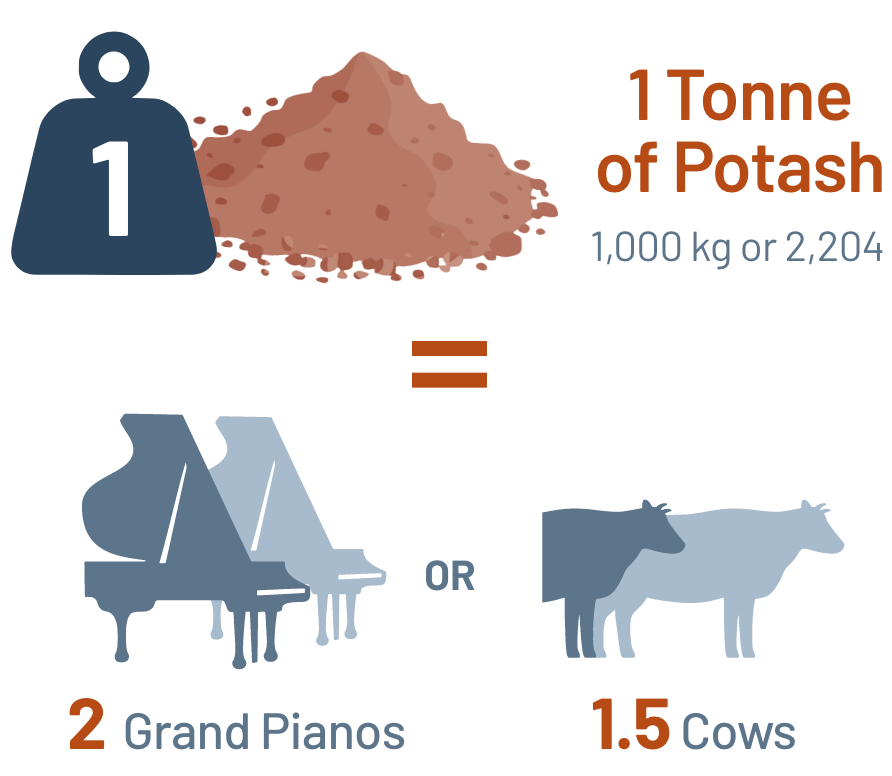

COST PER TONNE

1 British ton (long ton) = 1,016 kg or 2,240 lbs Typically the cost of potash is calculated as the cost it takes to create one tonne of potash COSTS INCLUDED

|

|||

In comparison to a Russian producer shipping overseas |

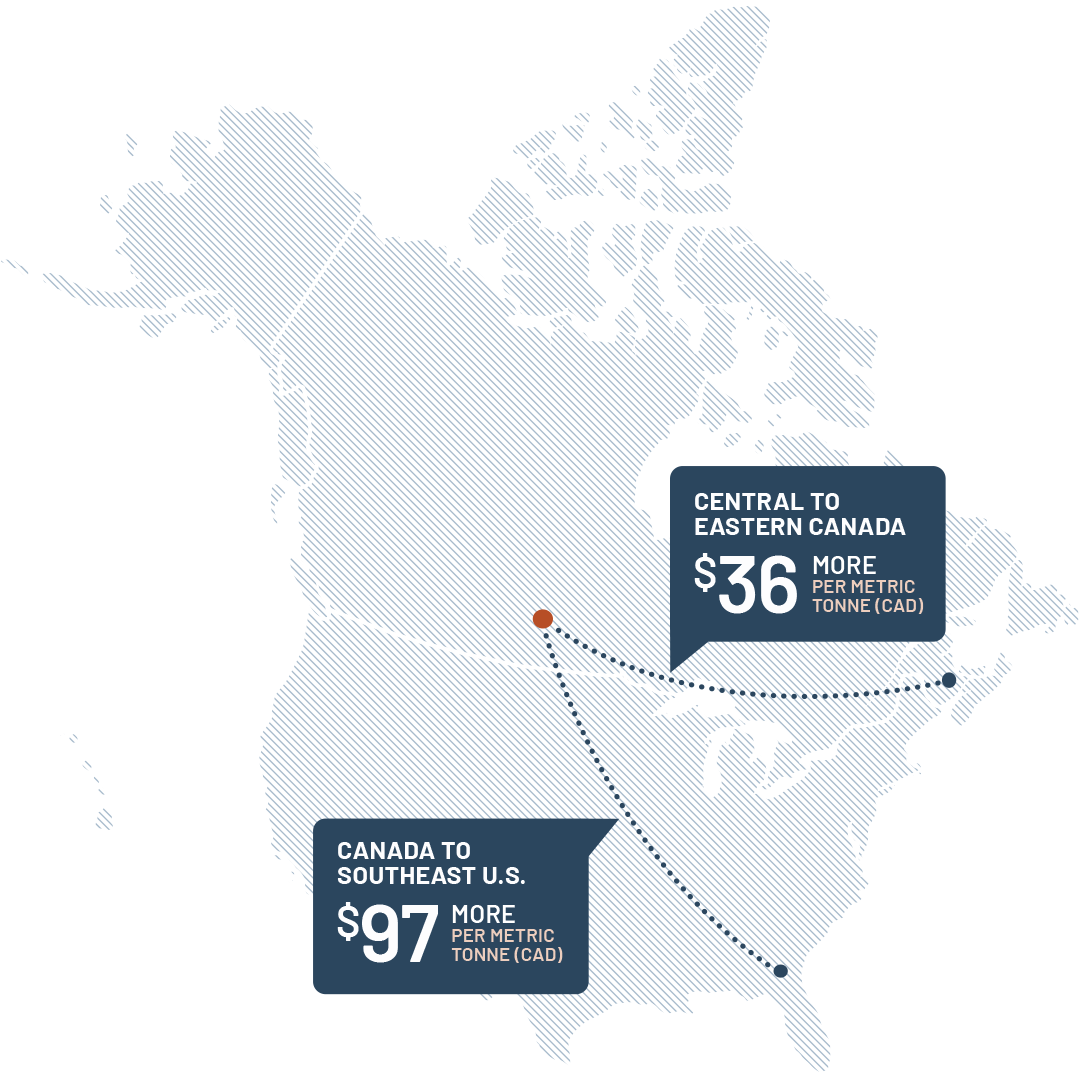

Transportation CostsCanadian potash has to move to either coast to get to global markets It costs significantly more for Canadian producers to move potash to ports on the east coast or in the US than for global producers to ship potash into North America.  |

|||

Canadian Potash Tax Treatment |

|

Crown Royalty tax is paid to the Crown for removing the mineral and selling it. Calculated as value of potash produced (average selling price) x 3% Base – producers estimate how much potash they will make in a year x 35% to a maximum and minimum; there are deductions available to incentivize new mine research and development along with market development to grow the industry – paid monthly Profit tax – producers estimate how much they will make in a year x 15% or 35% (based on amount sold in a year); there are deductions to encourage companies to build or expand mines, create corporate office positions, and do market/research development – paid quarterly Resource Surcharge tax – calculated as 3% of all third-party revenue sales of Canadian Potash. Potash base tax, potash profit tax, resource surcharge tax, provincial and federal income taxes, provincial and federal sales taxes, property taxes and carbon taxes (both direct and indirect). |

||

Tax BurdenIt’s estimated that Russian potash companies pay 43% less as a percentage of operating earnings It’s important for regulators to consider the collective impact many changes in different places have on overall cost compared to the competition We know taxes and costs will increase and change over time — that’s a given The goal should be to maximize the earning potential of the industry so Canadian producers are selling their potash and making more profit, so everyone’s share grows exponentially |

|

|||

|

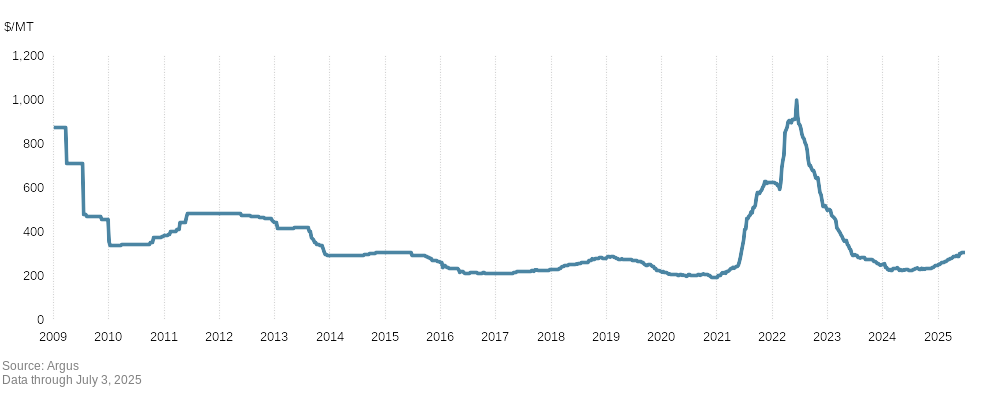

Priced to SellCOMMODITYPotash is considered a commodity, meaning it is interchangeable with commodities of the same type and is used as an input to produce other goods – like crops that are used for food NEGOTIATIONSPotash companies around the world negotiate with buyers to set volumes and prices for potash, based on the current market conditions CONTRACTSEach growing cycle comes with contract negotiations with the largest world importers like China and India PRICINGThe price of potash is set by the market not the seller and is based on what a customer needs at that time with what’s most readily available  |

|||

Price Factors |

PRICE IS BASED PER TONNE

|

POTASSIUM CHLORIDE PRICESVancouver F.O.B, standard, monthly, 2009 – 2025  |

||

|

TIME TO DIG DEEPERGet a better understanding of the basic business fundamentals of the potash industry. SHOW ME |

WHY IT ALL MATTERSPotash plays a major role in our economy. The facts are compelling. Dig in. SHOW ME |