Potash is brought to the surface from about a kilometre underground either as a solid or dissolved in liquid form

It’s processed in mills to separate out the “K” (potassium)

Further processed into various sizes and types of products.

From here, it’s stored in large warehouses for shipping where it will be later loaded into train cars

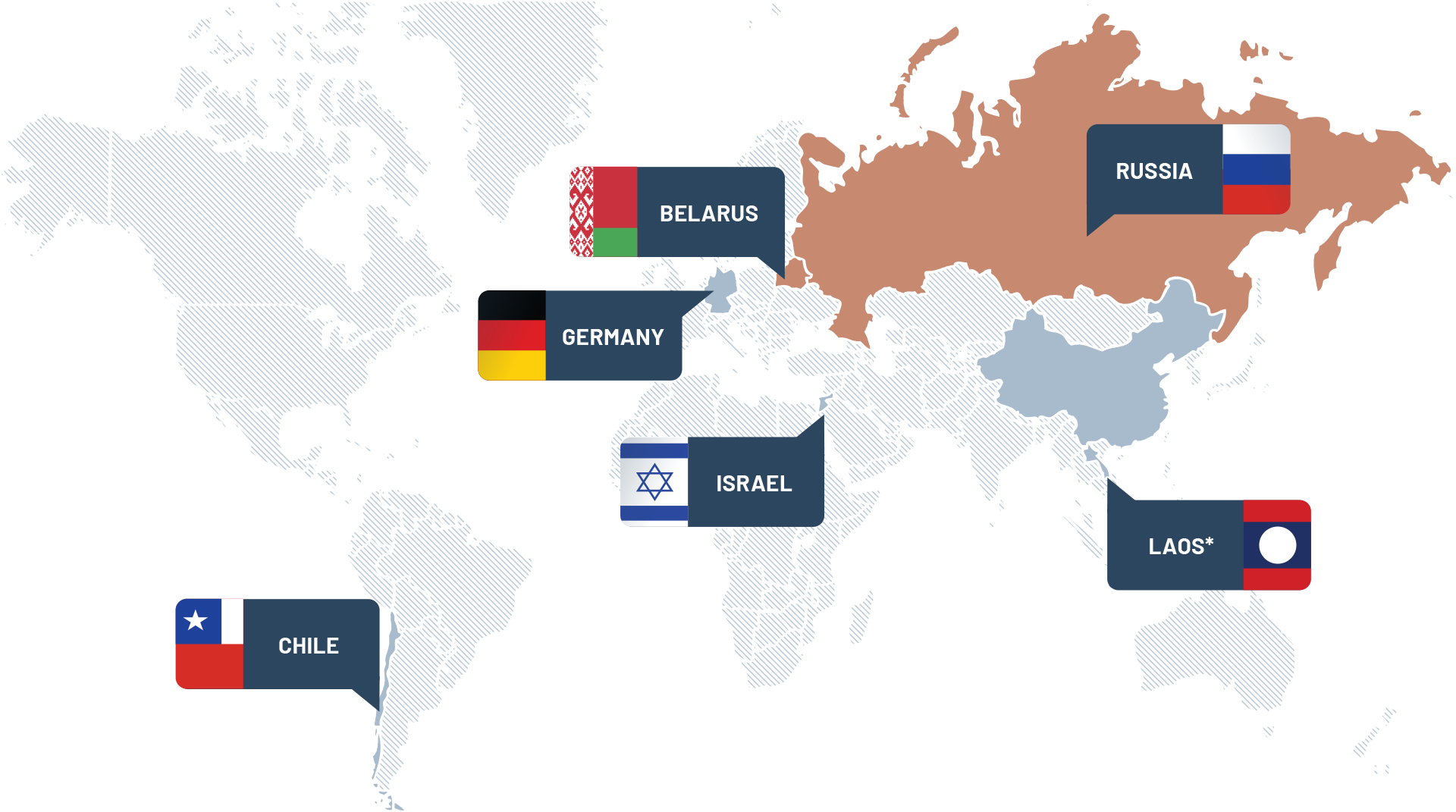

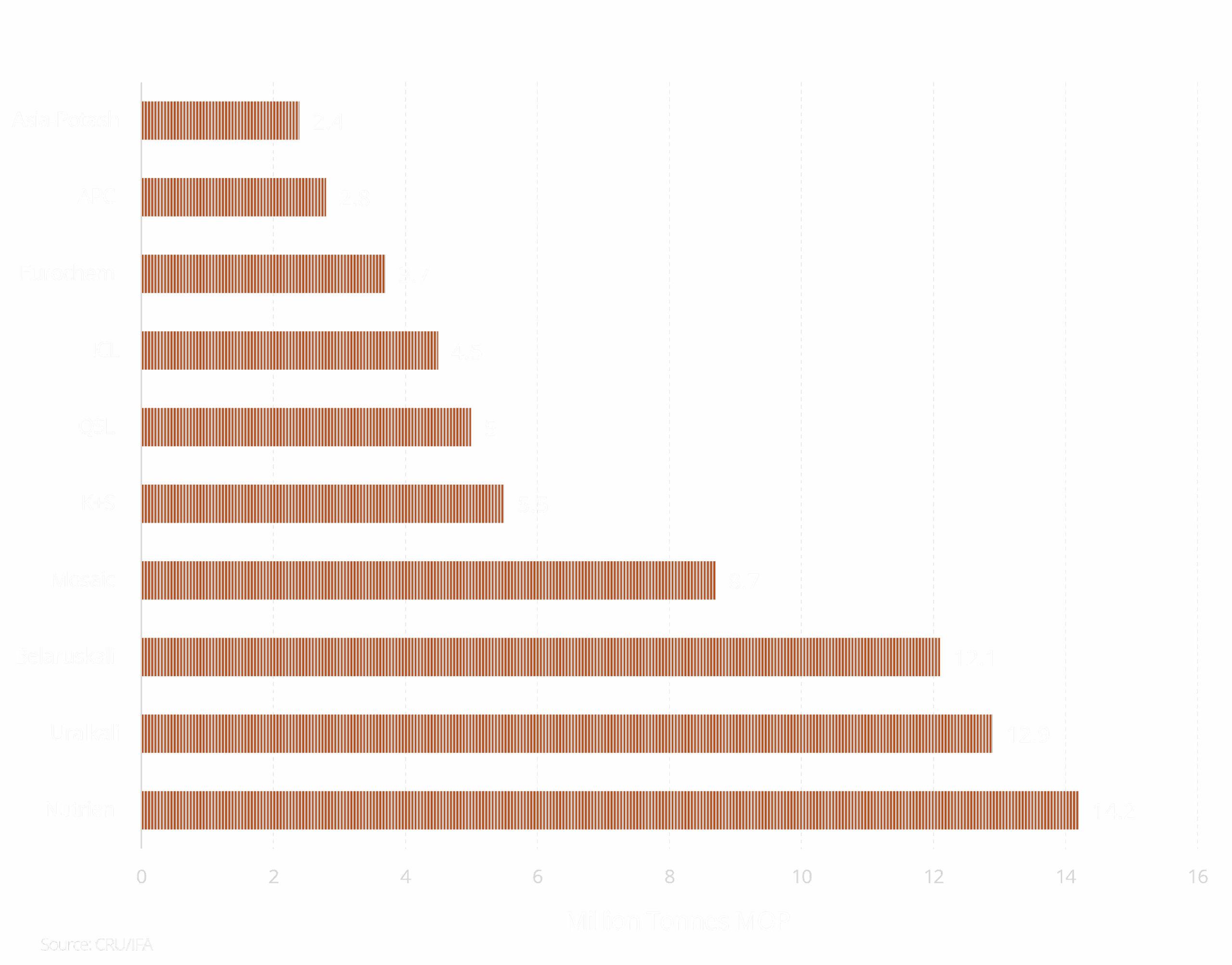

There are 7 projects underway in Russia and Belarus.

There are 2 projects being developed in Laos.

Exporters: Uralkali and Eurochem

Exporters: Belaruskali

Exporters: ICL

Exporters: SQM

Exporters: Lao Kaiyuan and Asia-Potash

*Chinese-owned

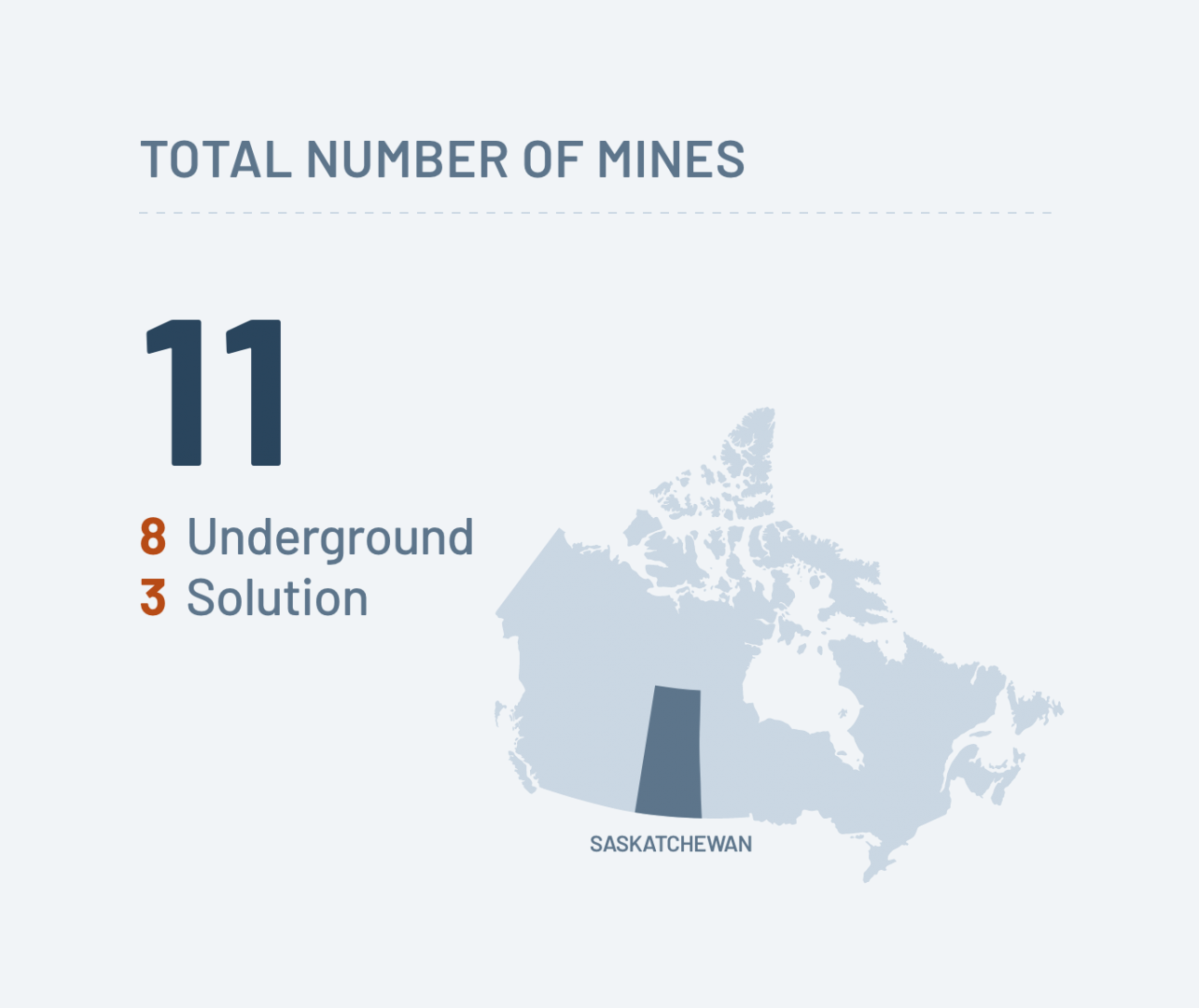

Based on 2024 Actuals & Estimates

95% is exported out of Canada Major markets: US, China, Brazil and India; 40 countries world-wide

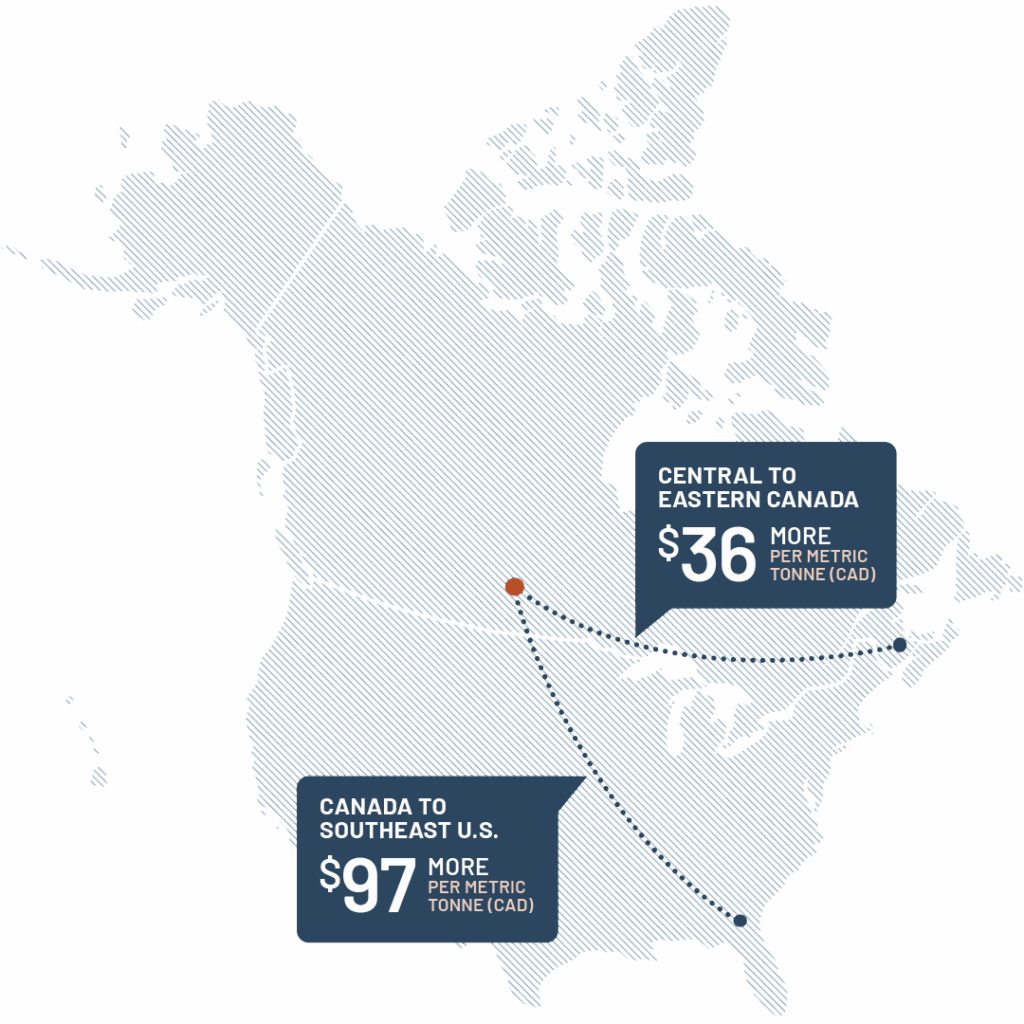

Potash is moved by train and relies on the services of CN and CP Rail

Potash is transported both by the producers themselves and for some, through Canpotex (a joint venture owned by Mosaic and Nutrien)

Canpotex markets and delivers Canadian potash through their fleet of 5,000 customized railcars to port terminal facilities in Portland, Oregon, Saint John and Vancouver

The three main producers own or lease specialized railcars to move product through their own supply chains

Rail cars are emptied into large containers and put on ocean-going vessels for global shipments

Each rail car carries 100 MT of potash (based on weight).

Once filled in Canada, cars move by rail to main hubs like Winnipeg or Chicago for domestic transport.

International cars head to ports on the East or West coast.

For Canpotex, it takes around a week to move potash from Saskatchewan to the coast.

Domestically, it can take over a month to get potash to its final destination by rail-only.

Crown Royalty tax is paid to the Crown for removing the mineral and selling it. Calculated as value of potash produced (average selling price) x 3%

Base – producers estimate how much potash they will make in a year x 35% to a maximum and minimum; there are deductions available to incentivize new mine research and development along with market development to grow the industry – paid monthly

Profit tax – producers estimate how much they will make in a year x 15% or 35% (based on amount sold in a year); there are deductions to encourage companies to build or expand mines, create corporate office positions, and do market/research development – paid quarterly

Resource Surcharge tax – calculated as 3% of all third-party revenue sales of Canadian Potash.

Potash base tax, potash profit tax, resource surcharge tax, provincial and federal income taxes, provincial and federal sales taxes, property taxes and carbon taxes (both direct and indirect).

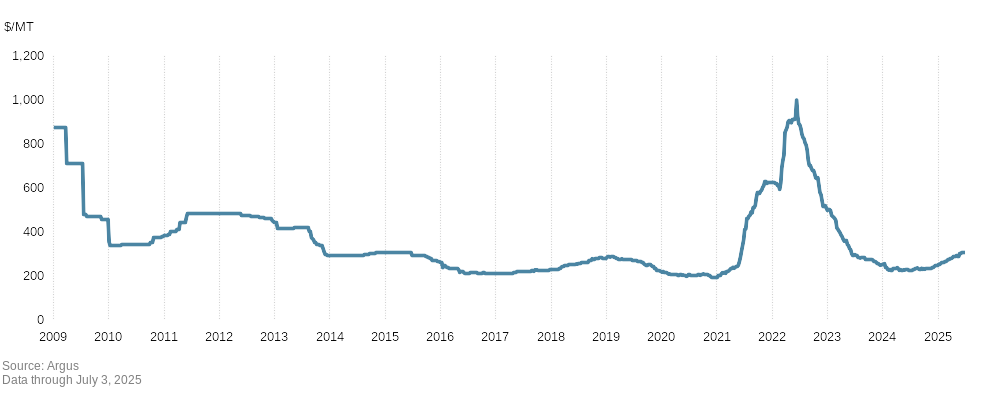

Supply:

how much is available

Demand:

how much is needed

Growing season and weather

Farmer disposable income

Government subsidies

Currency exchange rates

Tariffs and trade wars